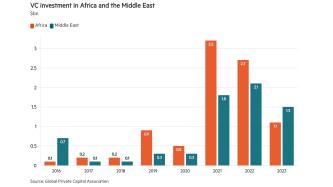

Middle East banks had the wind in their sails in 2022. Following on from the post-pandemic recoveries registered in 2021, the region’s major economies – whose currencies are mostly pegged to the dollar – benefited from windfalls from higher oil prices, with inflation in the main remaining at lower levels than among their global peers.

While slightly lower oil prices are likely to make future performance more muted, Middle Eastern lenders have improved their standing in The Banker’s Top 1000 World Banks ranking, with 22 of the region’s 25 largest banks climbing to a higher position.