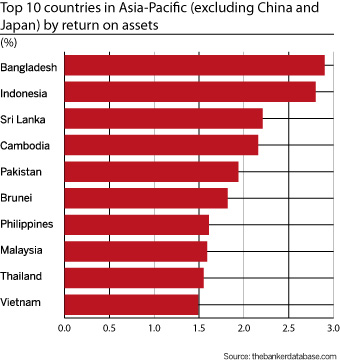

The Banker's Top 300 Asia-Pacific Banks excluding China and Japan ranking shows that Bangladeshi banks are the top performers in the region when it comes to return on assets (ROA), based on end-2010 results. Banks in the country recorded on average ROA of 2.9%, compared to Indonesian and Sri Lankan banks, which recorded ROAs of 2.8% and 2.21%, respectively.

Six Bangladeshi banks featured in the top 15 banks for ROA in Asia-Pacific (excluding China and Japan). National Bank was the top performer among them with an ROA of 6.55%. It ranked second in the table behind Sri Lankan-based DFCC Bank, which had an ROA of 8.91%.

Read more about Bangladeshi banks in The Banker's Top 300 Asia-Pacific Banks excluding China and Japan ranking.